Finance Resources

Access and download a range of financial resources to help you assess, understand, and apply for a loan with Australian Securities.

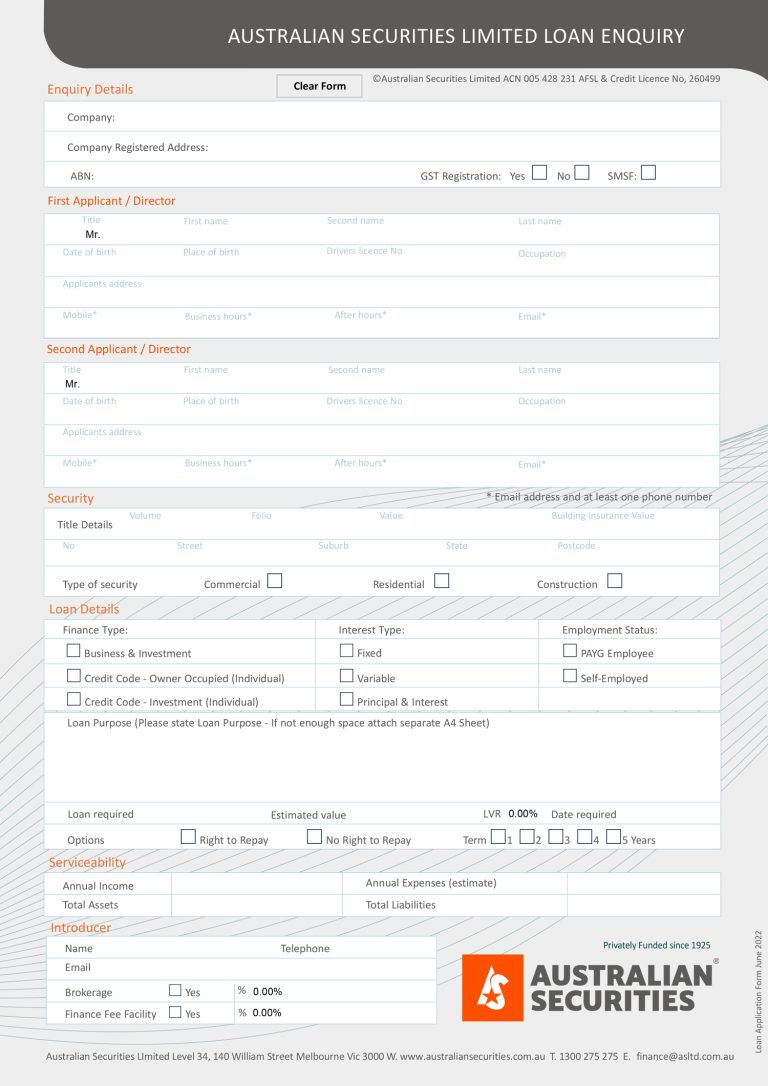

Loan Enquiry/Application Form

Lending Options & Features

Australian Securities are one of the few specialist lenders with experience and know-how to tailor loans that leave little to chance. We offer a range of terms flexible enough to accommodate individual business needs as they change during the loan term.

Finance Fee Facility™ for Brokers and Referrers

The free Australian Securities Finance Fee Facility is unique in how it facilitates client payments, offering greater control and transparency while building better client relationships.

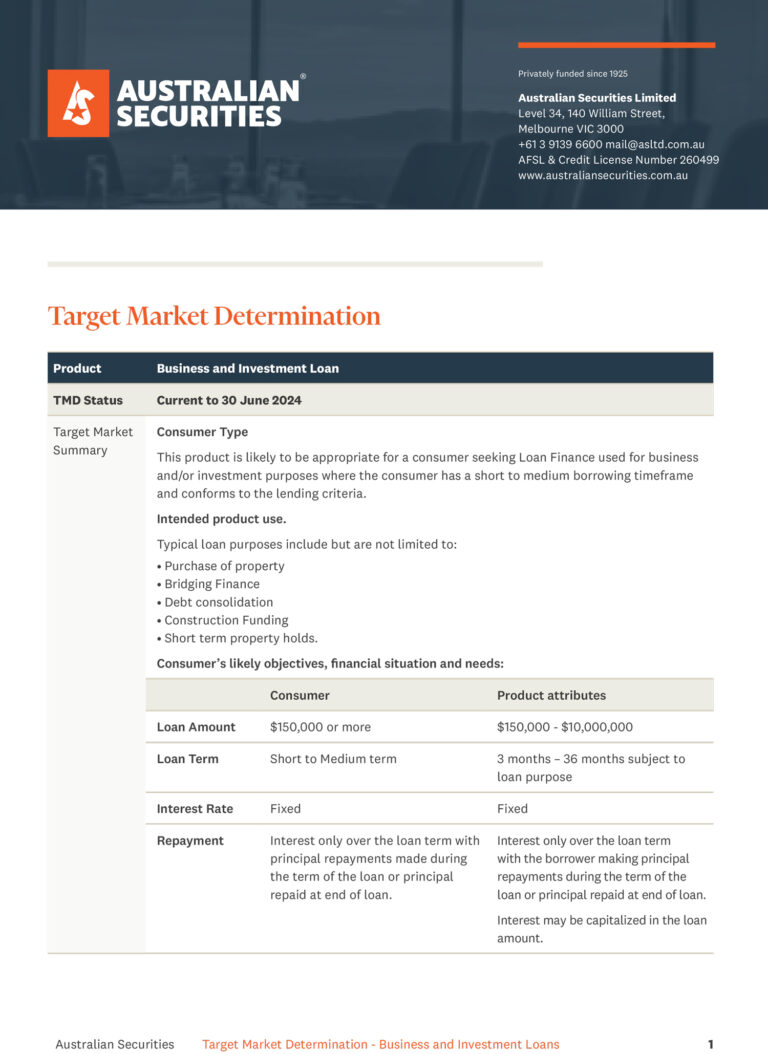

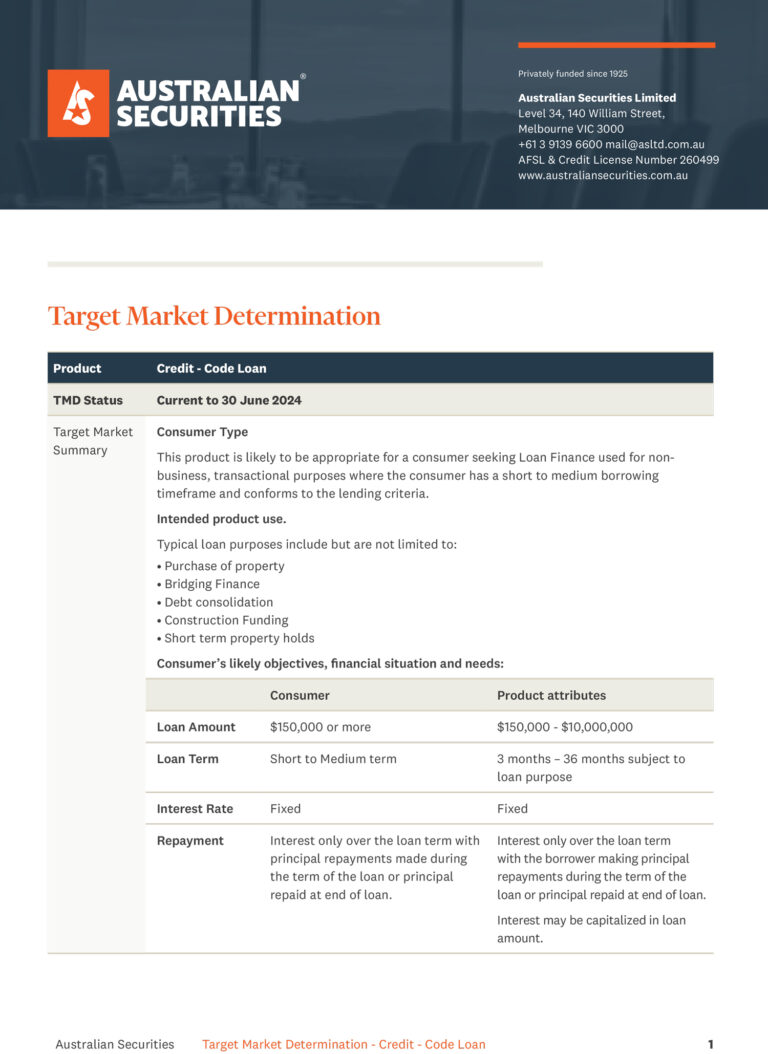

Finance & Loan Types

At Australian Securities, we recognise that most clients have unique lending requirements and, therefore, tailor finance packages to suit the individual needs of the customer and their business. These PDF Brochures illustrate the general features and benefits of borrowing from us.

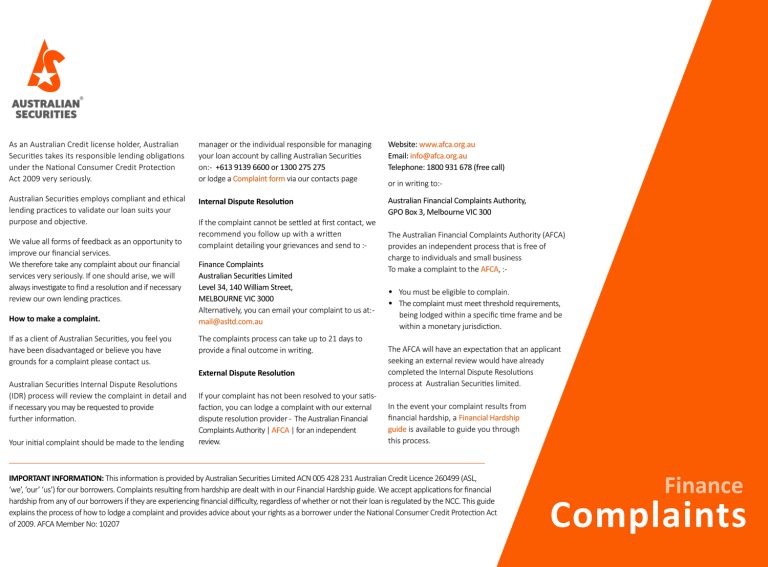

Finance Complaints & Hardship

Download the processes for issuing complaints or applying for hardship.

Your questions answered

Don’t see your question below. We’re happy to answer any questions you may have. Contact us online or call us on 1300 275 275. We don’t have call centres. You’ll talk directly to investment managers or executives, when you call.

What is private lending?

Private lending is an alternative to mainstream bank lending where borrowers can access loans direct from a Private Fund or other Lending entity, backed by private investors and not wholesale money markets.

What are some of the benefits of borrowing from a private lender?

The benefits of borrowing from a private lender really depend on the lender. At Australian Securities, borrowers benefit from competitive rates and loans tailored to specific lending requirements that most banks cannot provide.

Do you pay Brokers or Referrers commissions?

No. Australian Securities does not pay commissions, preferring a completely transparent customer lending service. Brokers can negotiate fees directly with their clients, and Australian Securities will pay the Brokerage Fee via the Finance Fee facility each month from their client’s repayments.

Who can borrow from Australian Securities?

Australian Securities lends to individuals, partnerships, companies,rustees, SMSFs. Our typical clients include professionals, property investors, small businesses, builders and developers, and SMSFs.

How does Australian Securities assess the value of a security provided for a loan?

We use a certified independent valuation agent to value the security for each loan.

Can I prepay interest?

Yes. Interest prepayment will depend on the loan type and exit strategy. A borrower can also service the ‘monthly in arrears’ interest from their own cash flow resources.

Can I repay early, and is there a penalty if the loan is repaid before the end of the loan term?

Yes, you can select a number of repayment options to discharge or partially discharge with no ‘early break costs’ (penalty) if the repayment option is chosen during your application.

How fast can loans be approved?

We will immediately indicate whether we can meet your lending requirements—conditional approval is given within 24 hours. Our usual time frame to turn around from application to settlement is 10 days, subject to a valuation, Quantity Surveyor and all information being readily available by the borrower.

What will happen if I default on my loan?

If you are experiencing difficulties or can foresee repayment issues, you should contact Australian Securities immediately before you default. If contact is made in good time, we may be able to remedy the situation. If you are experiencing financial difficulty, please contact AUstralian Securities on 1300 275 275 for assistance.

Should I worry about loan recalls?

Borrowers do not need to worry about a credit squeeze when they borrow from Australian Securities, as finance is provided privately by Australians and not wholesale money markets.

Can I rollover my loan on the final repayment date

Yes. If pre-approved with the borrower, options to roll over on the due dates are possible.